Folks,

Many people have been infatuated by the price of gold in recent months, but the price of silver has also skyrocketed. In 2000 silver was about $3.00 per troy oz. In the eight years that followed, its price grew to $15/oz. Today it is trading at over $41/oz! This price is almost an all time high, except for the time when the Hunt brothers tried to corner the silver market in 1980. The aberration of their efforts jolted the silver price to just short of $50/oz, but it settled down to $11 or so after the Hunts came under margin call and other pressures.

Unfortunately, the dramatic price increase today, does not appear to be an aberration. Although we may hope that it will soon drop to more historic levels, we may not have reason to expect that it will.

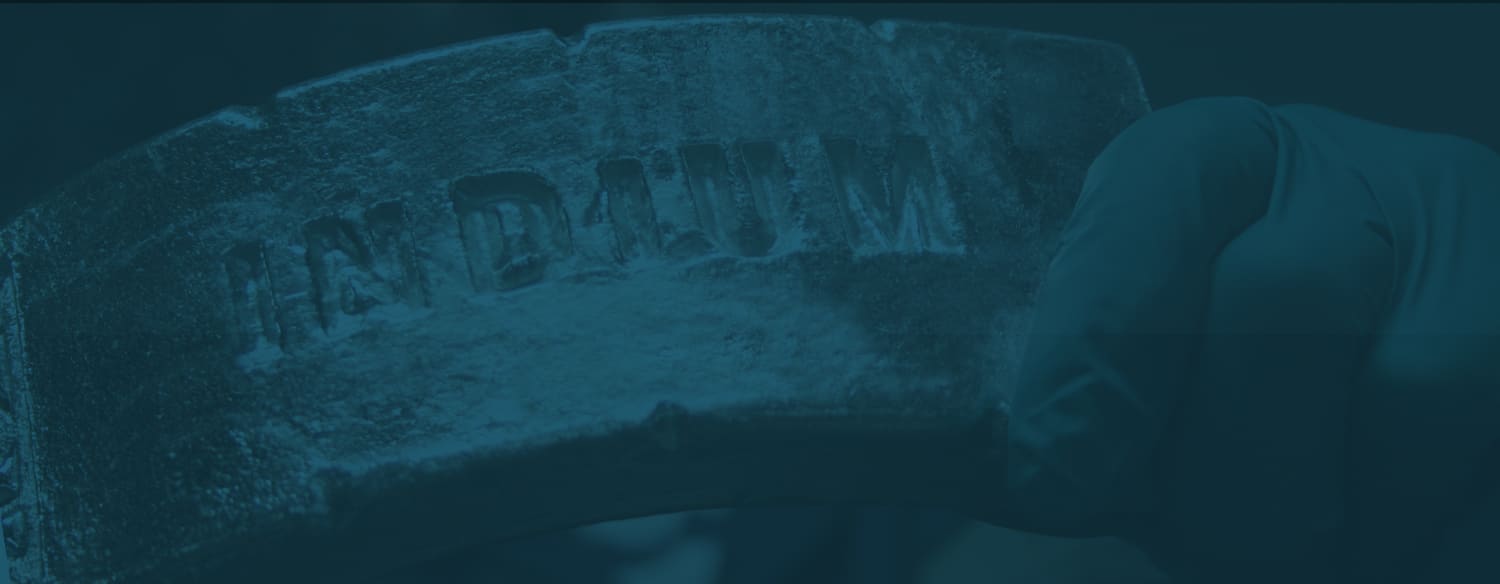

Although not as dramatic, tin and copper have experienced significant prices increases as well. The price of tin has doubled in the last year to $15/pound and copper has increased from about $3/lb to $4.50. These metals are obviously key ingredients in critical electronic materials such as solder pastes, solder bar, and solder preforms.

In addition, oil, which is used for most organic electronic materials such as PWB resins, flip chip underfill, and epoxy fluxes, has increased to $110/bbl - approaching its all time high of $145/bbl.

All of these price increases have a significant impact on the electronic materials supply chain. Although we are used to price decreases in the cost of our mobile phones and PCs, at this point in time, the price of the materials that go into these devices will be increasing.

As one materials supply chain executive commented at APEX, “It’s not like we can be clever and somehow work around the price increase of silver and these other materials, we have to pass it on to our customer, or go out of business.”

Cheers,Dr. Ron